Whether it is customized material on your social media sites feeds, instructing Alexa to alter the tune or using FaceID to get to encrypted information on your cellular phone, Artificial Intelligence (AI) is something we can no more overlook and in some cases, we can't envision living without it.

In this write-up, we will discover exactly how technological developments and also electronic makeover is urging an AI-enabled future in monetary services.

It is difficult to go over the function of AI in monetary solutions without highlighting that 2020 was extremely disrupted by COVID-19 and the ripple effect is expected to last for many years. Financial Institutions electronic makeover methods formerly specified for 2020 quickly unwinded, revealing the inadequacies to respond and respond swiftly when the pandemic grasped the globe at an unprecedented speed. The reality is AI is experienced by lots of people from early morning up until night.

There has been debate over real definition of AI as the expectations on whaAI Robot-1t is regarded as 'real knowledge' change so usually. At a top-level, AI as a field can be referred to as any type of strategy that enables equipments to resolve a job like just how people would certainly.

Maybe leveraging Artificial intelligence, which makes use of algorithms to allow computers to learn from examples without needing to be clearly programmed to make decisions; or Natural Language Processing, which is concentrated on creating meaning and also intent from text in a legible, all-natural form, or Computer system Vision, which is focused on removing significance and also intent from aesthetic aspects including pictures as well as video clips.

Increased electronic transformation

The increase of fintech and also new modern technologies over the last years has actually been considerable and this has actually impacted how customers engage with organisations and also subsequently has changed the financial solutions landscape. Altering customer expectations, fierce competition, increasing regulative stress and the pressure to boost operational effectiveness has actually seen the market force itself right into a reactive procedure where speed to market became much more crucial for survival. A brand-new age of open banking has actually allowed systems to swiftly and seamlessly incorporate with brand-new systems and applications. Physical banks and paper systems are swiftly being obsoleted and also changed by durable electronic communities, noticeable by the raising introduction of new electronic only challenger banks.

Digital improvement put simply is to reconsider what we currently create based on brand-new innovations available. It is the process of modernising what we have done before. A electronic improvement strategy should customize an organisation's reaction to crises, changing consumer behavior, and also wider market conditions. It is below that AI can really be leveraged.

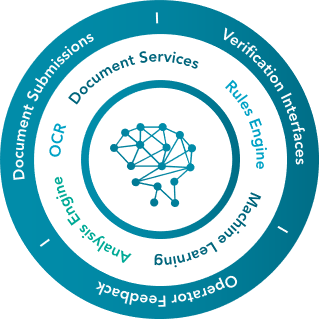

Duty of AI - Online Assets_4

AI quality in monetary services

Financial organisations are spending huge amounts of funding in digital capabilities such as chatbots, artificial intelligence (AI) and open APIs. The primary advancements over the past sixty years have been developments in search algorithms, artificial intelligence formulas, and also incorporating analytical evaluation into recognizing the world at large. The positive effects that AI is having on monetary services is expanding.

Using AI in credit decision-making has actually come to be progressively typical, with the potential to make quicker much more exact credit choices based on an broadened set of readily available information. AI-assisted underwriting supplies a 360-degree sight of an applicant. It accumulates huge and also standard data; social, business as well as web data; and also disorganized data.

AI is playing critical role in fraud avoidance by assisting to analyse client behaviour to expect or determine deceptive purchases. Utilizing a equipment learning-based scams discovery option could be educated to spot fraudulence within more than one type of deal or application, or both of these at the same time.

Much of the discuss AI in banking has actually had to do with exactly how technology can replace some features currently performed by human beings. Nonetheless, AI could likewise assist financial organisations serve their customers better by providing easier accessibility to pertinent information.

It is thought around 50% of hand-operated work could be automated. These duties normally include exercises in very foreseeable as well as organized environments, along with information collection and also information processing. Refine automation is widely beneficial for economic service customers as their account applications, including borrowing as well as conserving, can be accelerated dramatically.

According to Goldman Sachs, machine learning as well as AI will certainly make it possible for adelaide bank broker ₤ 26 billion to ₤ 33 billion in annual " expense financial savings and brand-new revenue possibilities" within the financial field by 2025.

Obstacles to fostering of AI in monetary services

Numerous firms and fields delay in AI adoption. Creating an AI method with clearly defined advantages, locating ability with the appropriate ability, conquering functional silos that constrict end-to-end deployment, and lacking ownership and commitment to AI for leaders are amongst the obstacles to adoption most often cited by executives.

Lacking a society of advancement-- stakeholders within organisations hold immense power in the success of AI projects. Numerous economic organisations have small risk cravings this is filtered through magnate on the ground responsible for IT change activities. When it comes to skill, training as well as upskilling are vital. However this should not be simply focused on the innovation teams. Business groups additionally need to be upskilled in the art of the possible when it concerns AI, in addition to a few of the downsides as well as other factors to consider.

Data infrastructure - monetary services companies commonly experience as their information is usually siloed throughout multiple technologies and also groups, with logical capabilities usually concentrated on specific use instances. The demand to standardise data as well as guarantee data is accessible is crucial.

Information personal privacy as well as cyber protection - the use of personal details are crucial issues to resolve if AI is to know its possibility. The General Data Security Law (GDPR), which presented extra rigid authorization requirements for data collection, offers customers the right to be failed to remember and the right to object which is a favorable step in the best direction. Cybersecurity and also frauds that could control perpetrate large-scale fraud are also a concern.

Scrutinised prices - Expenses in AI tasks are commonly scrutinised by money and elderly leaders as the initial ROI is low. AI abilities are long-term tactical investments so greater returns would be expected better down the line.

AI presents technological opportunities like nothing else. Released from the orbit of science fiction, this is a real-world innovation that is ready to be executed in any service-- today.

The abilities of AI modern technologies will remain to expand greatly as substantial information sets required for training AI remedies end up being a lot more obtainable. The time to carry on AI is now. Reduced barriers to access will certainly bring ever before fiercer competition for AI ability, AI patents and also AI abilities.

AI adopted early will transform the way banks organise, run, increase and attain development. By implementing new cutting-edge modern technologies, financial organisations will certainly endeavour to minimize costs and produce much better experiences for consumers as well as workers alike. This requires organisations to completely reassess their general business procedures including their labor force, a cultural change is called for to embrace brand-new methods of working and innovations.

The usages as well as capabilities of AI remain to grow and also change everyday. This post highlights crucial variables and also benefits to be taken into consideration as well as more expedition is motivated. AI should not be thought of as a service tool or extension of technology yet instead as a transformative social change that needs to be thought about in a extremely wide, multi-dimensional context.